Enhancing MSME Financing in the UAE

Leveraging Data Transparency with Government Support

05 March 2024 | Kempinski Central Avenue Dubai

Objective

The workshop will delve into how government organizations can play a pivotal role in mitigating these risks and bolstering business activity. By providing increased transparency through access to previously unavailable datasets, government organizations can create a more favorable environment for MSME financing. This approach aligns with the World Bank’s recommendations on facilitating SME financing through improved data access and transparency.

Context

The in-depth and interactive workshop will help attendees learn:

Global trends in boosting MSME financing and their growth potential by enhancing their financial health transparency through improved data access.

Global best practices to Improve the quality and accessibility of public records, as well as establishing clear data sharing policies.

Best Practices on how successful partnerships between government and private sectors are leading to the creation of more comprehensive credit profiles for MSMEs, offering lenders a clearer picture of their financial standing.

International efforts to standardize and harmonize commercial credit reporting across borders to ensure the consistency and reliability of data, further increasing lender confidence in MSMEs.

World Bank's recommendations for facilitating MSME financing, solidifying its alignment with global best practices.

Expected Outcomes:

Understanding Best Practices: Attendees will gain insights into successful implementations from other jurisdictions (examples: United Kingdom’s Small Business, Enterprise and Employment Act; US Consumer Finance Protection Board’s action), based on case studies and the World Bank's recommendations.

Collaborative Strategies: The workshop will foster dialogue on how government bodies, financial institutions, and MSMEs can collaborate to improve access to financing.

Policy Recommendations: Development of actionable policy recommendations for the UAE government organizations to support MSMEs.

Networking and Knowledge Exchange: Opportunities for stakeholders to network and exchange ideas on improving MSME financing infrastructures.

Future Roadmap: Drafting a roadmap for implementing these strategies in the UAE, with an emphasis on digitalization and transparency in SME operations.

Senior Government Managers: Specifically, those holding roles linked to MSME development, digitization strategies, and business activity enhancement within the UAE. Their insights and decision-making powers are crucial for shaping policies and frameworks that support MSME growth and financing.

Representatives of the SME Ecosystem in the UAE: This includes key figures from business and trade industry associations. Their participation is essential to provide a ground-level perspective on the challenges and needs of SMEs in the current economic landscape.

Representatives of the Financing Industry: Particularly those with an active role in MSME financing. This includes leaders from banks, non-banking financial institutions, and fintech companies. Their involvement is critical to understanding the financial landscape and developing innovative financing solutions that cater to the unique needs of MSMEs.

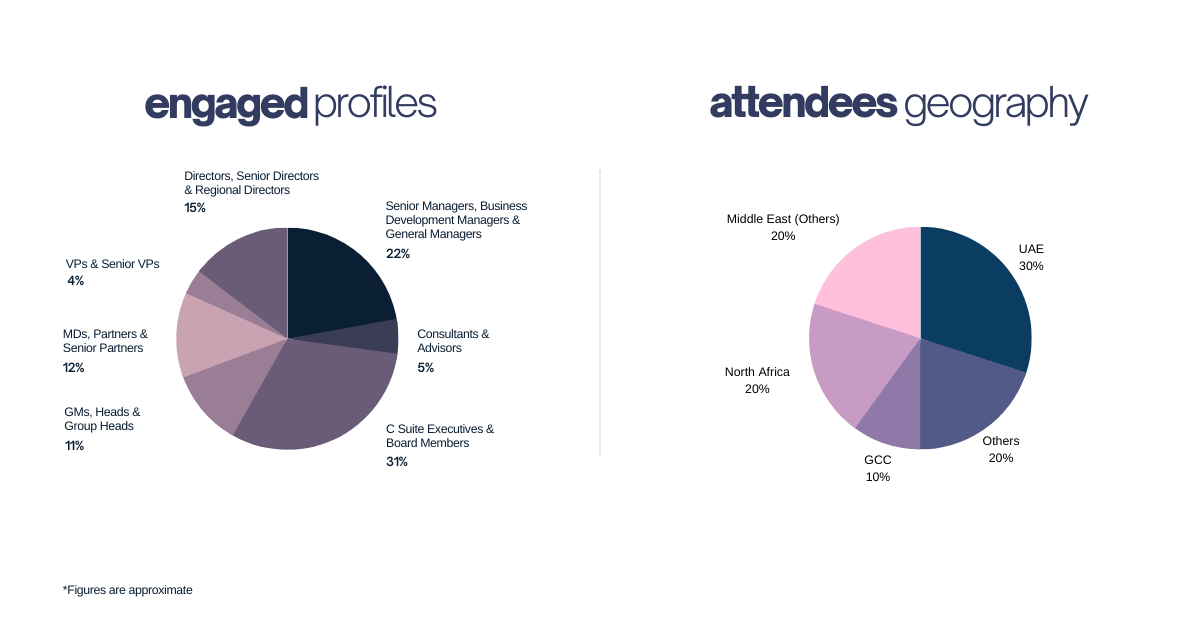

companies

Engaged

Gallery

Everything you need to know about UNLEASH World 2023. From downloading the app, to finding your way to our venue and conference centre.

- Kempinski Central Avenue

- Dubai, UAE